AXIS INTERNET BANKING: Axis Bank account holders can use online banking services to access different banking functions from the convenience of their homes and offices. Customers can now monitor and manage their financial transfers with the aid of online banking.

Customers will open savings accounts, bill payment, open a fixed deposit, apply for a credit/debit card, order a new checkbook, make cheque payment requests, and other financial transfers without needing to go to the bank. view their account activities, download prior account statements, and perform a variety of other tasks.

What is Axis Internet Banking?

Axis Bank provides both online and offline Axis Bank online Banking Registration to all Axis Account Holders. If you’ve got the time, you should apply for Axis Bank Internet Banking offline by going to the Axis Bank website. If you don’t have time or don’t want to go to the bank to unlock your Axis Bank NetBanking login, you can register for Axis Bank Online Banking online from your house. Then go ahead and read the whole article.

Since Axis Connect is also known as Axis bank Net Banking, this knowledge must be grasped. You should register for Axis Net Banking online and activate Axis Internet Banking by following the steps outlined in this article.

How to register for Axis Net Banking?

You’ll need a few things to get started, including your Customer ID, Account Number, and Debit Card. Your customer ID will be found on your chequebook or passbook, and a debit card will be included in the welcome package you received while creating an Axis Bank NetBanking registration account.

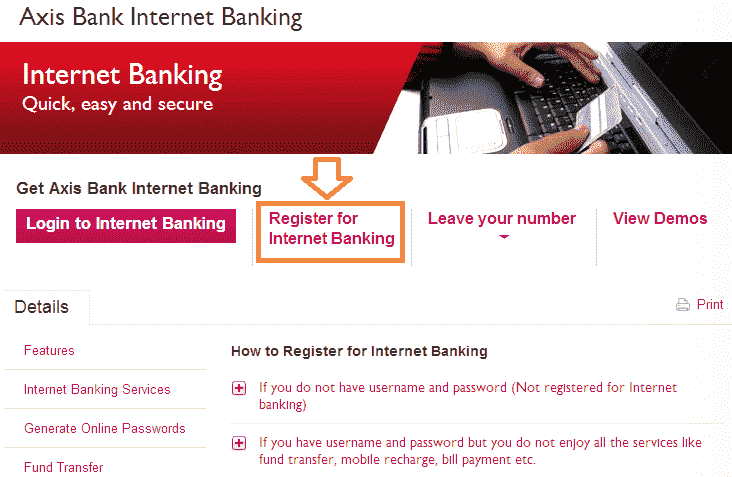

- To begin the procedure, go to Axis Bank’s official NetBanking registration page.

- After you’ve opened the site, choose the “Register” button. It’ll be on the left-hand side of the frame.

- The first thing you’ll need to do is type your Login ID and then press “Submit” to continue.

- Your Customer ID is your Login ID, which you can find on your chequebook if you don’t already remember.

- On the next page, type your Bank Account Number and the telephone number that you provided when you applied for the account.

- Since you will be getting a one-time password on the phone number linked with your Bank Account, it must be available.

- After you’ve entered all of your bank account information, you’ll be asked to enter your debit card information.

- Simply enter your ATM card’s 16-digit number, expiration date, and PIN code, then press “Send.”

- Choose “Indian Rupee – INR” as the hard currency from the drop-down menu.

- To continue with the registration process, make sure you understand the Terms And Conditions.

- You have finished the Axis Bank Online Banking Registration Process in its entirety.

- All you’d have to do is double-check all of the details, such as the Account Number, Password, and OTP, to make sure everything is right.

- After reviewing all of the details, simply click “Submit” to complete an application form.

How to login Axis Net Banking?

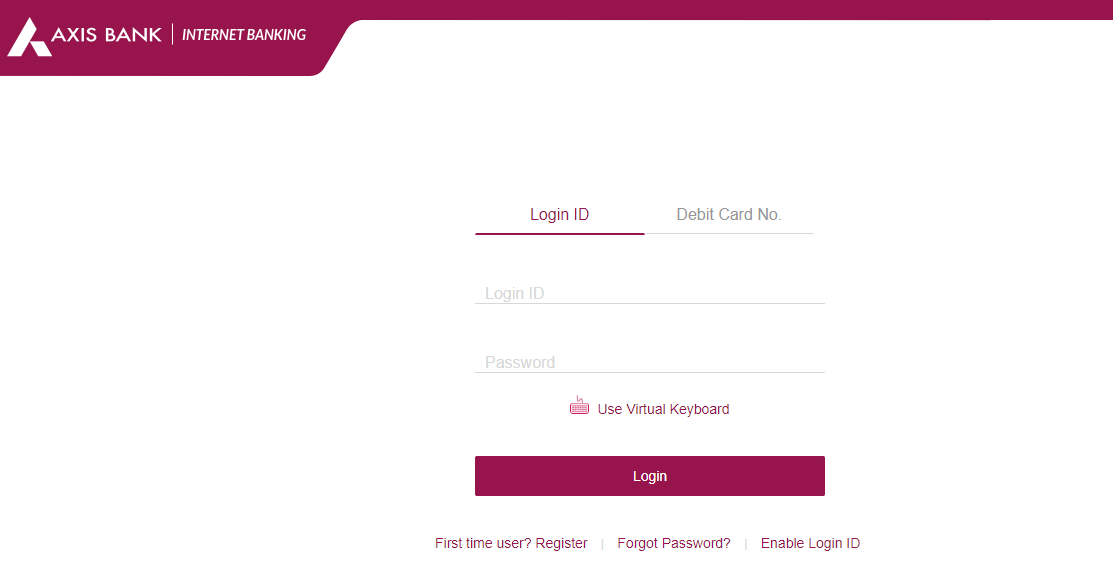

- Customers of Axis Bank must take the steps outlined below to access the Net Banking portal.

- Press on https://www.axisbank.com/bank-smart/internet-banking/features-services to go to the official website Axis Bank net banking homepage.

- Press Continue to log in now.

- Enter your Login credentials on the next tab, then press the Login button.

How to Reset/Forget My Axis Online Banking Password?

To restore or forget your Axis Net Banking password, follow the instructions below.

- Log in to your Axis Bank Internet Banking account.

- On the Axis net banking login tab, press the “Forgot Password” button.

- Enter your User Name here and then press the “Proceed” button.

- After that, type your 16-digit Debit Card code, PIN, and bank-registered telephone number.

- Set a new password for Axis Net Banking login by inserting a new password.

- If you don’t have a debit card, you should order a PIN from the call centre or at a branch near you.

How to use Axis Bank Net Banking to transfer funds?

Net Banking helps Axis Bank customers to move money from their Axis Bank accounts to other Axis Bank accounts or to other institutions. Users must, though, apply the beneficiary account’s account information until moving money.

The following is a step-by-step guide to transferring funds through Net Banking:

- To begin, enter your Login Credentials into the Axis Bank Net Banking Portal.

- Select the Transfer Fund alternative from the Accounts page.

- On the next page, select “My Own Axis Bank Account,” “Other Axis Bank Account,” as the form of money transfers.

- Select the account to which the funds should be credited now.

- Then, type the number and the account to which the money will be transferred.

- After you’ve double-checked all of the details, check the terms and conditions box and press Ok.

- To complete the transaction, enter your username And password.

- Finally, the progress message would appear on your phone.

Advantages of Axis Net Banking :

The ease of Axis net banking login is its most important value. In certain ways, it is superior to physically go to the bank:

- The account manager can make a deposit from anywhere – he or she does not need to go to a bank counter because he or she has access from home, work, or even while on vacation.

- Axis Bank Internet Banking Login helps customers to perform transfers at any time, regardless of the bank’s operating hours.

- The account is open 24 hours a day, seven days a week, so the account manager does not have to think about Sundays.

- For financial transfers, anybody can use any computer with an internet connection – phones, computers, desktops, tablets – everything.

- Banks have a wide variety of services, including bill paying, money transfer, and online checking account transfers.

- Since all transactions are directly updated, the account holder still has access to the details without having to file any slips or paperwork. Since the mechanism is fully automatic, the account is still up to date and free of inconsistencies.

Is it necessary to sign up for Net secure?

It is important to register with Net secure if you want to make financial transactions such as transfer money, pay bills, or recharge your devices. You won’t be able to do all of these things until you register for Netsecure. You will just look at your account details.

How do I turn between Net secure 2 options?

If you want to change the Net secure mode, go to your online banking account and log in. Select the mode you want to register for by clicking the “Register For” button.

Is there a fee for using Axis Bank’s Internet Banking?

No, there are no costs involved with using Axis Bank’s Internet Banking facilities. If Axis Bank customers pass funds to a third party through different modes such as NEFT, RTGS, or IMPS, the third party’s bank can charge a fee for the money transfers.

Conclusion:

Your Axis Bank account must be active before you can register with the Axis Bank Internet Banking service. You would not be allowed to apply for Internet Banking if your account has been frozen or is in an inactive state. But, first and foremost, go to the local bank and get your account activated after it has been inactive. If you have any questions comment below section.