As the Indian banking market is increasing, new commercial and cooperative banks are catering to the needs of individuals and businessmen. Though the Indian banking market faced alot of troubles due to natural calamities, government rules, frauds, and huge losses, still these banks are the pride of our nation.

Today, we’ll be talking about one such oldest Indian commercial bank, UCO. UCO or United Commercial Bank was established in the year 1943 in Kolkata. It is one of the major government-owned commercial banks in our country. Further, in this article, we’ll be talking about UCO internet banking and its features.

What Are The Features Of UCO Internet Banking Or Netbanking?

- UCO internet banking allows customers to transfer their funds to different accounts within few clicks. Even after this bank is hugely expanding, the customers are still experiencing less server issues and transaction failures.

- UCO internet banking is easy to understand due to its user-friendly interface. Recently, UCO has added various other features to its internet banking and mobile banking. These features were majorly related to the security of accounts. Some convenience features were also added by UCO.

- Through UCO internet banking, you can control your debit card. You have the freedom to block/unblock your card without connecting with customer care. You can even set spending limits on your debit card.

- UCO internet banking allows customers to pay their rent and bills and earn some instant cashback and rewards. UCO Smart Pay is one of the best and latest features added by this bank to transfer funds directly to merchant’s accounts.

- If you prefer investing in the stock market of trading, UCO e-trading is best for you. It allows you to invest your hard-earned money safely and assist you throughout the investment process. For more information, visit the official internet banking portal of UCO Bank.

What Is The Registration Process Of UCO Net banking?

- Once you are the customer of UCO bank, you can avail all the services of internet banking. Go to the UCO official portal and click on the ‘Netbanking’ option. Under that, click on the ‘New Registration’ option.

- Now, you have to enter your account number. Further, you have to enter any one of the last 5 transaction amounts. Agree to the terms and conditions.

- On the next page, you have to complete the OTP verification process. The One-Time password will be sent on your mobile number. Enter that and click on the ‘Submit’ button.

- Now, on the next page, you have to enter all the 16 digits of your debit card, including the pin code and expiry date. Hit the ‘Submit’ button.

- This is the final process where you have to generate a login password and transaction password. After creating both the passwords, click on ‘Submit.’ Now, your UCO internet banking registration process is completed.

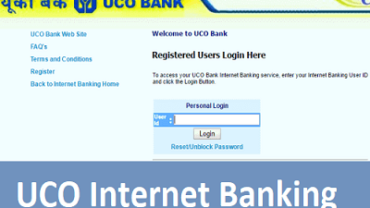

Login Process Of UCO Internet Banking

- Again, you have to visit the official portal of UCO Bank. Find the internet banking login option.

- Click on that and agree to all the terms and conditions. Further, enter the username and password. Finally, click on the ‘Login’ button and access your account.